FIDELITY INDIA CHILDREN'S PLAN

Also visit http://equityadvise.blogspot.com

Srikanth Matrubai is known as the WEALTH ARCHITECT. He is practitioner of Wealthy Habits and author of Amazon Best Selling Book DON'T RETIRE RICH. We strongly urge to follow your Advisor. This blog is purely for information. However, we strongly suggest you to consult a Financial adviser. This blog is purely for information purposes only and we do not take any responsibility whatsoever as the blog content may be changed from time to time and is generic in nature.

Sunday, January 23, 2011

FIDELITY INDIA CHILDREN'S PLAN - A REVIEW

It’s Different!

While most Child funds in the mutual funds are hybrid in nature with very little to differentiate each other, Fidelity has tried to create its own space by adding unique options hereto unavailable in child plan by Mutual funds.

The Fidelity India Children's Plan has provided investors with a good variety of unique investment options.

OPTIONS....

The Fidelity India Children’s Plan will have three sub Funds which you can choose…

- Education Fund : Asset allocation under the Education Fund will comprise of 70 per cent equity and 30 per cent debt to provide funds over the long-term for children''s education.

- Marriage Fund : The Marriage Fund will have asset allocation of 70 per cent equity, 20 per cent gold ETFs and 10 per cent in debt.

- Saving Fund : The Savings Fund will have only Debt exposure and the asset allocation will be up to 100 per cent in debt and money market instruments to provide stability.

You can watch the Video of how the Fund works …………

Here..

Fidelity India Children’s Plan (FICP) is a hybrid fund which combines equity, fixed income instruments and gold ETFs. The fund offer three distinct funds under it viz. Education Fund, Marriage Fund and Savings Fund, where one can invest in, and each of them are intended to achieve their stated objective. Investors can opt for any of the funds for their investments, depending upon their financial goal – being children education, marriage or mere savings.

The FICP “Education Fund” exposes its investors to two asset classes – equity and debt, while the FICP “Marriage Fund” exposes its investors to three major asset classes – equity, debt and gold. The FICP “Savings Fund” on the other hand invests only in debt and money market instruments.

These Hybrid options give investors exposure to low co-related assets. So, when you feel that Gold is not looking attractive as investments, Equity will take care of your returns.

In contrast to most hybrid mutual funds in the market, Fidelity India Children's Plan will have dedicated fund managers for both the equity and debt portions of the portfolios. The Equity Portion will be managed by Nitin Bajaj who also has a good track record in managing Fidelity Special Situations Fund.

RECOMMENDATION :

Fidelity has understood the physic of Indian investors well and has included "Gold" also in its Marriage Fund. Gold has been long considered a natural hedge against inflation and Indian Marriages do have more than 20% of their expenses directed towards Gold.

The Fidelity India Children's Plan can be considered with a long term view. The Fund has all the potential to ensure good returns. Its Gold Exposure should ride out volatility and beat inflation over the long term. The auto balancing would ensure that downside is protected.

Savings Fund which invests predominantly in debt and money market instruments suitable for conservative investors and those nearing their financial goals and

Instead of looking at Child ULIPs, you should seriously consider investing in this Fund, as the costs are not only cheaper, but also the withdrawal are easy and returns should be far superior.

So, the vote is INVEST.

NOTE :

There will be no charge for switching between different options of the same fund or between funds within the plan and for transfers under STP.

Srikanth Matrubai

Also visit

http://equityadvise.blogspot.com

Friday, January 7, 2011

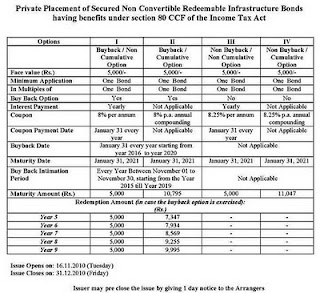

IFCI INFRA BONDS.... SHOULD YOU INVEST??

Infrastructure Bonds are back as they allow you to claim extra 20000 as Deductible from your Income. But, are they worth it??

Hi,

As you are aware, the Finance Minister in the recent budget has announced a special Income Tax rebate, wherein investment made upto Rs.20,000/- in Bonds issued by Infrastructure Companies will be eligible for Income Tax benefit u/s 80-CCF.

Following this, IDFC, L&T had earlier come out with Infrastructure Bonds and now IFCI too has come with a public issue of such Tax Saving Bonds.

On an investment of Rs.20k, an individual in the Top Tax Bracket of 30% can make a saving of Rs.6000 and also earn an interest of 85 to 8.25%. However, for the Highest Bracket Tax Payer, the effective yield works out to 14.25%…..

These Bonds typically have a minimum tenure of 10 years and will be locked for 5 years. Since, the Bonds are expected to be listed on the Stock Markets, liquidity concerns are negated to some extent.

Those Tax payers who have exhausted their Exemption for Investments of Rs.1 lakhs in Sec 80c, 80ccc, 80ccd can look at these Infra Bonds.

HOW MUCH TO INVEST?

Even though there is no upper limit for investing in these bonds, since a maximum of Rs.20000 is deductible from your Taxable income, do NOT invest more than Rs.20000 in these Bonds.

Features of the present IFCI Bond open for subscription :

Face Value Rs. 5,000/- per bond

Issue Price At par (Rs. 5,000/- per bond)

Minimum Subscription 1 Bond and in multiples of 1 Bond thereafter,

Tenure 10 years, with or without buyback option after five years

Options for Subscription The Bonds are offered under the following 4 options-

• Option I – Non-cumulative and Buyback after 5 years

• Option II – Cumulative and Buyback after 5 years

• Option III – Non-cumulative and no Buyback

• Option IV – Cumulative and no Buyback

Redemption / Maturity At par at the end of 10 years from the deemed date of allotment. For Cumulative Option, at par with cumulated interest thereon.

Coupon rate • Option I & II – 8% p.a.

• Option III & IV – 8.25% p.a.

Option II and Option IV will have cumulative payment at the end of the Buyback period or 10 years, as per the option opted by the Investor.

Rating : BWR AA- by BRICKWORK RATINGS INDIA PVT LIMITED implying these Bonds carry high credit quality

Listing Proposed to be listed on BSE

Interest from IFCI BONDS are not subjected to TDS , but it is TAXABLE at the hands of investors.

The IFCI bonds are issued with section 80CCF benefits which means that they will get you a tax benefit of reducing your taxable income over and above the Rs. 100,000 under Section 80C with a cap of Rs.20,000.

These IFCI 80CCF bonds will not attract TDS, however the interest itself is taxable at your hands. So, the bonds don’t attract TDS, but it doesn’t mean they are tax free.

LET ME ALSO CLARIFY....

If you have already bought another infrastructure bond, and exhausted the limit of Rs. 20,000 then you won’t get any further tax benefit by buying this bond. There are also several banks that offer 8% interest for terms less than 5 years, so you won’t get much value out of locking your money in this instrument for 5 years.

ONE MORE IMPORTANT NOTE.....

LIC is also expected to come out with its Infra Bonds...

This bonds from LIC is expected to not only give MORE interest but also OFFER FREE TERM INSURANCE.

So, you can wait for some more time...

Regards,

Srikanth Matrubai

Also visit

http://equityadvise.blogspot.com

Hi,

As you are aware, the Finance Minister in the recent budget has announced a special Income Tax rebate, wherein investment made upto Rs.20,000/- in Bonds issued by Infrastructure Companies will be eligible for Income Tax benefit u/s 80-CCF.

Following this, IDFC, L&T had earlier come out with Infrastructure Bonds and now IFCI too has come with a public issue of such Tax Saving Bonds.

On an investment of Rs.20k, an individual in the Top Tax Bracket of 30% can make a saving of Rs.6000 and also earn an interest of 85 to 8.25%. However, for the Highest Bracket Tax Payer, the effective yield works out to 14.25%…..

These Bonds typically have a minimum tenure of 10 years and will be locked for 5 years. Since, the Bonds are expected to be listed on the Stock Markets, liquidity concerns are negated to some extent.

Those Tax payers who have exhausted their Exemption for Investments of Rs.1 lakhs in Sec 80c, 80ccc, 80ccd can look at these Infra Bonds.

HOW MUCH TO INVEST?

Even though there is no upper limit for investing in these bonds, since a maximum of Rs.20000 is deductible from your Taxable income, do NOT invest more than Rs.20000 in these Bonds.

Features of the present IFCI Bond open for subscription :

Face Value Rs. 5,000/- per bond

Issue Price At par (Rs. 5,000/- per bond)

Minimum Subscription 1 Bond and in multiples of 1 Bond thereafter,

Tenure 10 years, with or without buyback option after five years

Options for Subscription The Bonds are offered under the following 4 options-

• Option I – Non-cumulative and Buyback after 5 years

• Option II – Cumulative and Buyback after 5 years

• Option III – Non-cumulative and no Buyback

• Option IV – Cumulative and no Buyback

Redemption / Maturity At par at the end of 10 years from the deemed date of allotment. For Cumulative Option, at par with cumulated interest thereon.

Coupon rate • Option I & II – 8% p.a.

• Option III & IV – 8.25% p.a.

Option II and Option IV will have cumulative payment at the end of the Buyback period or 10 years, as per the option opted by the Investor.

Rating : BWR AA- by BRICKWORK RATINGS INDIA PVT LIMITED implying these Bonds carry high credit quality

Listing Proposed to be listed on BSE

Interest from IFCI BONDS are not subjected to TDS , but it is TAXABLE at the hands of investors.

The IFCI bonds are issued with section 80CCF benefits which means that they will get you a tax benefit of reducing your taxable income over and above the Rs. 100,000 under Section 80C with a cap of Rs.20,000.

These IFCI 80CCF bonds will not attract TDS, however the interest itself is taxable at your hands. So, the bonds don’t attract TDS, but it doesn’t mean they are tax free.

LET ME ALSO CLARIFY....

If you have already bought another infrastructure bond, and exhausted the limit of Rs. 20,000 then you won’t get any further tax benefit by buying this bond. There are also several banks that offer 8% interest for terms less than 5 years, so you won’t get much value out of locking your money in this instrument for 5 years.

ONE MORE IMPORTANT NOTE.....

LIC is also expected to come out with its Infra Bonds...

This bonds from LIC is expected to not only give MORE interest but also OFFER FREE TERM INSURANCE.

So, you can wait for some more time...

Regards,

Srikanth Matrubai

Also visit

http://equityadvise.blogspot.com

Subscribe to:

Posts (Atom)

Have you read the best seller DON'T RETIRE RICH ?

Labels

- Articles

- Asset Allocation

- Awards

- Balanced Funds

- Best Fund to Invest

- ELSS

- EMI

- FEES

- Festivals

- Financial Planning

- Fluctuation

- Fund Call

- Goals

- Gold ETFs

- Gold/Silver

- Insurance

- Insurnace

- interviews

- Investment Advise

- IPO

- Learning

- Liquid Funds

- Loan

- Marriage

- MF Lessons

- Mutual Fund Advise

- NFO

- Opinion

- Others

- REITS

- Retirement

- Seminar

- SIP

- Small Caps

- Sports

- Star performers

- Stocks

- Tax Planning

- Videos

- Volatility

- Wealthy Habits

- Women