PMVVY is a Government subsidised Pension Plan Scheme for Senior Citizens which entatils them to get GUARANTEED 8% return in Monthly Mode and 8.3% return in Annual Mode.

Senior Citizens require a No-Risk, Non-fluctuating and reasonable rate of return product and to address this issue, the PMVVY has been launched.

Even with its soft launch, within 2 months, the scheme has collected Rs.2705 crores.

Features :

1. Implemented by LIC

2. Entry Age : 60 years.....(Maximum - No limit)

3. Polity Term : 10 years

4. Plan open from 4th May 2017 till 03/05/2018

5. On Death of subscriber, Entire Deposited Amount will be refunded to Nominee/Legal Heirs

6. On Maturity at 10 years, Policy Holder will get the Last Due Pension along with the Intiail Deposited Amount

7. In rare cases like Critical Medical Emergency, the policy can be surrendered before maturity at a surrender value of 98% of Purchase price.

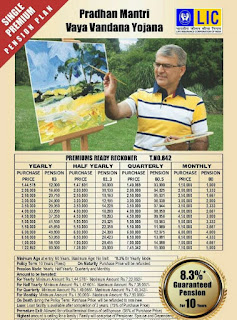

8. Minimum Amount is 1,50,000 for Monthly mode

9. Maximum Amount is 7,50,000

10. Minimum Pension / Maximum Pension

Monthly - 1000 5000

Quarter - 3000 15000

Half Yearly - 6000 30000

Yearly - 12000 60000

For Rs.1000/- you will get

Yearly :– Rs.83 every year.

Half-Yearly :– Rs.81.30 every year.

Quarterly :– Rs.80.50 every year.

Monthly :– Rs.80 every year.

Positives :

1. GUARANTEED interet of 8% for 10 years that too options like Monthly, Quarterly, Half-yearly and Yearly.

2. GST will not be levied on this plan.

3. Surrender (redemption) before 10 years can be done in extra ordinary cases like critical illness of self or spouse.

4. Exempted from Service Tax or GST.

5. Loan can be availed upto 75% of Purchase price.

Loan interest will be recovered from pension instalments...whereas the Loan Principal will be recovered from Maturity proceeds.

6. Since the scheme is backed by Govt, it is absolutely SAFE.

Negatives :

1. Pension will be added to other income for tax assessment.

2. Liquidity concerns as only Loan facility available that too after 3 years.

Especially, the fact that in Old age, there could be regular health related issues and in such a scenario, this scheme does not give you easy liquidity.

3. Taxes!!!!!

Pension paid will be added to your total income and tax will be calculated accordingly (if the total income comes under the tax bracket).

4. No cumulative Benefit.

5. The ceiling of Rs.7,50,000 covers entire family including pensioner, pensioner's spouse and dependants and hence may not be sufficient to many.

6. Not Inflation adjusted.

Assuming inflation at 7%, the purchasing power of Rs 5,000 would reduce to Rs 2,500 in 10 Years.

COMMENTS :

With falling interest rates, the scheme is definitely attractive especially because the interest is GUARANTEED at 8% throughout the tenure of 10 years.

8% may appear attractive in the present circumstances but going forward may not be enough as Inflation pressure will extract higher expenses from you.

Entry age should have been 55 years as even those in that age bracket too would already be planning for their retirement.

Taxation is a HUGE negative. Govt could have given an exemption to at least to those who get Rs.3000 per month.

FINALLY,

If you are looking for a SAFE, GUARANTEED long term product then PMVVY looks good otherwise you can consider SCSS (SENIOR CITIZEN SAVINGS SCHEME) as it provides better liquidity.

If you are just retired, you may outlive the policy term of 10 years and could get into REINVESTMENT RISK especially as you may need not just regular pension but INCREASING PENSION to meet RAISING EXPENSE.

Alternatively, Senior Citizens can look at Tax Free Bonds, Secured NCDs, SCSS, especially MIPs from Mutual Funds and even Balanced Funds, espeically if you are in Higher Tax Bracket and have just retired.

CAVEAT :

Do consult your Financial Advisor before taking any Decision.