Regular Portfolio Reviews

Essential for Your Financial Success

Just like a plant in Garden need regular care to flourish,

our portfolio and investments too need periodic review to ensure that they are

growing as planned.

A Review is an effective way to know whether we are on the

right track. Even the best of plans can go awry due to unforeseen and

unavoidable changes in life and circumstances.

Reviewing and rebalancing your investments regularly (at least annually) helps

you spot risks, fine-tune your strategy, and make sure you are on track to

reach your goals.

This habit helps you to capture market upsides, avoid potential losses and create

a sustainable, goal-driven investment journey.

Annual rebalancing helps ensure your investments do not become too concentrated

in one area, and it can keep you from being over exposed to market changes.

WHEN TO DO PORTFOLIO / FINANCIAL REVIEW:

1.

SIGNIFICANT CHANGE IN LIFE SITUATION:

Suppose there is a SALARY HIKE or Promotion. This affects not only your income

positively but also your lifestyle too could see a shift in accordance with the

higher income.

This also means that the original Rs.6 crores that you estimated to be enough

for your retirement could well short of lifestyle requirements ensuring a higher

target.

Even a change in the area where you are living could result in dramatic lifestyle

shift, thus needing a portfolio/financial review.

2.

EXTREME MARKET VOLATILITY:

Extreme market fluctuations may result

in equity losing value bringing down your overall portfolio value. Regular

reviews help portfolio safeguard investments against market movements and keep

risk under control. For instance,

extreme high markets mean equity valuation portion in portfolio might shoot up making

it necessary for you to book profits in equities and move to safer options like

Gold/Debt. This naturally helps in overall portfolio health.

3.

REGULARTORY CHANGES:

Introduction of new guidelines, updates on new features by regulators like

SEBI/AMFI/IRDA could leave a lasting impact on your portfolio. Staying informed

and reviewing your portfolio helps you ensure it remains compliant and aligned

with these regulatory shifts.

4.

PERFORMANCE ANALYSIS:

Fund performance varies, and no fund will be always at the top of table or at

the bottom of table.

Extremely volatile funds needs to be moved out of portfolio and identifying

such funds during review helps in moving to much more stable fund (as needed)

Holding onto poorly performing funds out of habit or hope can hurt your overall

returns. Instead, look for funds that better match your financial goals and

risk tolerance.

5.

TAX EFFICIENCY:

Tax changes are inevitable and unavoidable. These tax changes could

significantly impact portfolio by way of higher tax outgo. Regular review help

in revealing assets / funds which can benefit you from a tax point of view and

help you get more returns.

AVOID

THESE MISTAKES DURING PORTFOLIO REVIEWS:

1. DO NOT CHASE

PERFORMANCE

Before jumping in to invest a BIG amount in the recent No.1 Fund... remember

the biggest disclaimer

PAST PERFORMANCE MAY NOT BE INDICATIVE OF FUTURE RETURNS.

While this disclaimer is valid for every asset class like Gold, Silver, Real

Estate, and Equities...it is more prominent in Mutual Fund performance. Past

Performance is like a rear-view mirror showing only what has been rather than

where you will be going!

Step back a bit and look at the bigger picture and consider a broader

perspective, rather than just the short-term jump.

Remember, investing is a marathon, not a sprint. While it is natural to be attracted

of investing of High Growth fund, it’s prudent to focus on building a portfolio

that is built to last. By prioritizing consistency over short-term gains, you

are taking a significant step towards achieving your long-term financial

objectives.

2. AVOID EMOTIONS

It's natural to

feel worried when the stock market takes a downturn. However, reacting

impulsively by selling your investments can be a costly mistake. For instance,

during the 2020 market crash, many investors panicked and sold their equity

mutual funds. Those who stayed invested, however, reaped the rewards of the

subsequent market recovery.

Stick to your long-term financial plan & focused on your

goals, you can weather market volatility and achieve your financial

aspirations.

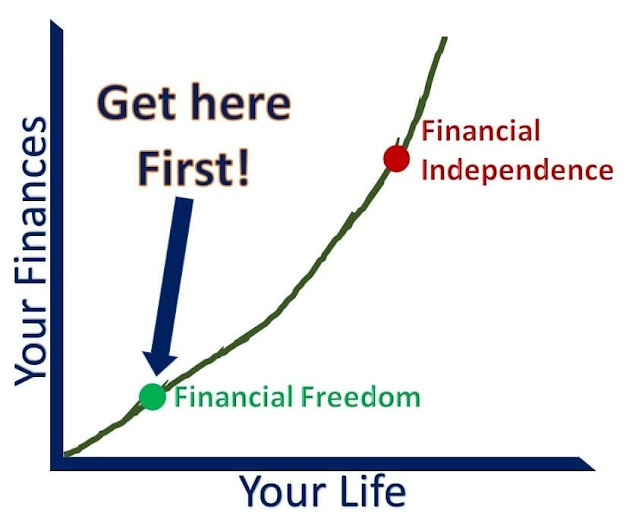

CONCLUSION:

Regular portfolio reviews are your way of “weeding and

watering” your financial garden, ensuring it stays healthy and growing toward

your goals.

With these examples in mind, make a habit of reviewing and rebalancing your

investments—it’s the difference between hoping for a bright financial future

and actively building one.

Make your roots strong.

Ensure that you have a Super Strong Portfolio capable of weathering all storms

and having sufficient exposure to all types of asset classes with the

right percentages and allocation. If the roots are strong, the need to act

seldom arises.

But, do note, regular Portfolio review and monitoring is a definite YES.

Portfolio

Reviews are necessary, but changes are not!!

Regards,

Srikanth Matrubai

You are strongly encouraged to consult your financial planner before taking any decision regarding this investment. The views expressed here is the authors personal views and should not be intrepresented as a recommendation to invest/avoid.